Liquidity is one of the most fundamental concepts in crypto trading. It determines how efficiently you can enter and exit positions, how much you pay in transaction costs, and ultimately whether your trading strategy can work profitably in real market conditions.

Defining Liquidity in Crypto Trading

Liquidity refers to how easily a cryptocurrency can be bought or sold quickly without causing significant price movement. In a liquid market, your order gets filled instantly at or near the current price because there are plenty of willing counterparties. In an illiquid market, your order struggles to find a match, causing delays or forcing you to accept worse prices.

The key is the relationship between order size and price impact. High liquidity means you can trade substantial size without moving the market. Low liquidity means even modest orders cause noticeable price changes.

For example, buying $50,000 of Bitcoin on Binance happens instantly at the current ask price. Buying $50,000 of a small-cap altcoin might push the price up 5-10% because few sellers exist at current levels.

Characteristics of High Liquidity Crypto Markets

High Trading Volume: Liquid crypto markets process enormous volume daily. BTC/USDT regularly sees $20-50 billion in 24-hour volume across major exchanges. ETH/USDT trades $10-20 billion daily.

Narrow Bid-Ask Spreads: The spread represents your immediate transaction cost. On major pairs like BTC/USDT, spreads might be just $1-5 (0.002-0.01%). This means you lose minimal value entering and exiting positions.

For scalpers who profit from small price movements, spread width directly impacts profitability. Platforms like Skaply, designed specifically for fast crypto scalping, connect to exchanges offering the tightest spreads, recognizing that every dollar matters when capturing small moves repeatedly.

Fast Execution: Liquid crypto markets fill orders almost instantaneously. You click buy, and you're filled within milliseconds at or very near your intended price. This execution speed allows traders to act on opportunities before they vanish.

Deep Order Books: Examining the order book shows substantial buy and sell orders stacked at multiple price levels. BTC/USDT might have millions of dollars in orders within 0.5% of current price.

Price Stability: Individual orders don't dramatically move prices in liquid markets. A $100,000 Bitcoin purchase might move price by $10-20. The same purchase on a small altcoin could spike price 15-30%.

Characteristics of Low Liquidity Crypto Markets

Illiquid crypto markets present challenging conditions:

Wide Spreads: Small altcoins often show 0.5-2% spreads, meaning you lose that percentage immediately upon entering. Some extremely illiquid tokens show 5-10% spreads.

Slippage: Your orders fill at prices noticeably different from intended. You try to buy at $1.00, but limited liquidity means you fill at $1.03-1.05 for the full order.

Slow Execution: Orders may take minutes to fill completely, during which price can move substantially against you.

Price Manipulation Risk: With few participants, whales can more easily manipulate prices through wash trading or coordinated pumps and dumps.

Why Liquidity Matters for Crypto Scalpers

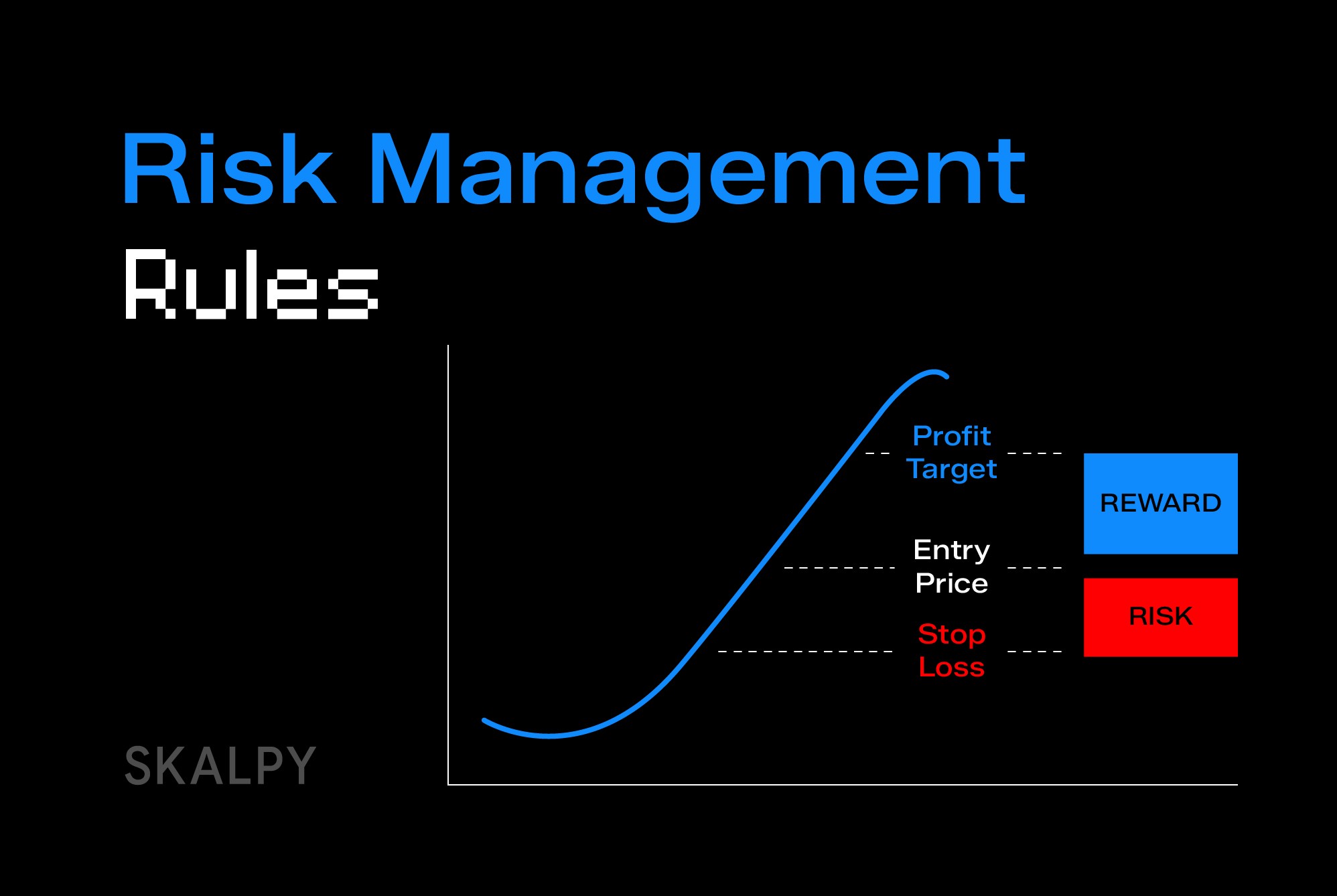

Scalping depends absolutely on high liquidity. Scalpers target tiny profits per trade, often just $5-20, executing dozens or hundreds of trades daily. This strategy simply cannot work in illiquid markets.

Spreads Kill Scalping Profits: If you're targeting $10 profit per trade but the spread is $8, you need the market to move significantly just to break even. On liquid pairs with $2 spreads, you only need small movements to profit.

Slippage Destroys Thin Margins: When you try to scalp 0.2% moves but slippage costs you 0.15%, your edge evaporates. Liquid markets minimize slippage, allowing you to enter and exit at expected prices.

Speed Enables Opportunity Capture: Scalping requires acting on fleeting opportunities. In illiquid markets, by the time your order fills, the opportunity has passed. Liquid markets provide instant execution.

Tools like Skaply help scalpers access the liquidity pools where their strategy can function profitably, connecting to major exchanges during peak activity hours when liquidity is optimal.

Measuring Crypto Liquidity

24-Hour Volume: Higher volume generally indicates better liquidity. BTC/USDT with $30 billion daily volume offers excellent liquidity. A token with $500,000 daily volume is illiquid.

Order Book Depth: Examine how many buy and sell orders exist at various price levels. Deep order books with substantial size within 0.5-1% of current price indicate good liquidity.

Bid-Ask Spread: The simplest liquidity measure. Spreads under 0.05% indicate excellent liquidity. Spreads over 0.5% suggest caution. Spreads over 1% indicate poor liquidity unsuitable for active trading.

Exchange Matters: The same crypto pair shows different liquidity across exchanges. BTC/USDT on Binance offers far superior liquidity to BTC/USDT on a small exchange.

[Insert Image 2 here: Crypto Liquidity Indicators] Image description: Dashboard showing volume chart, order book depth visualization, spread width meter for major crypto pairs Place after the paragraph above

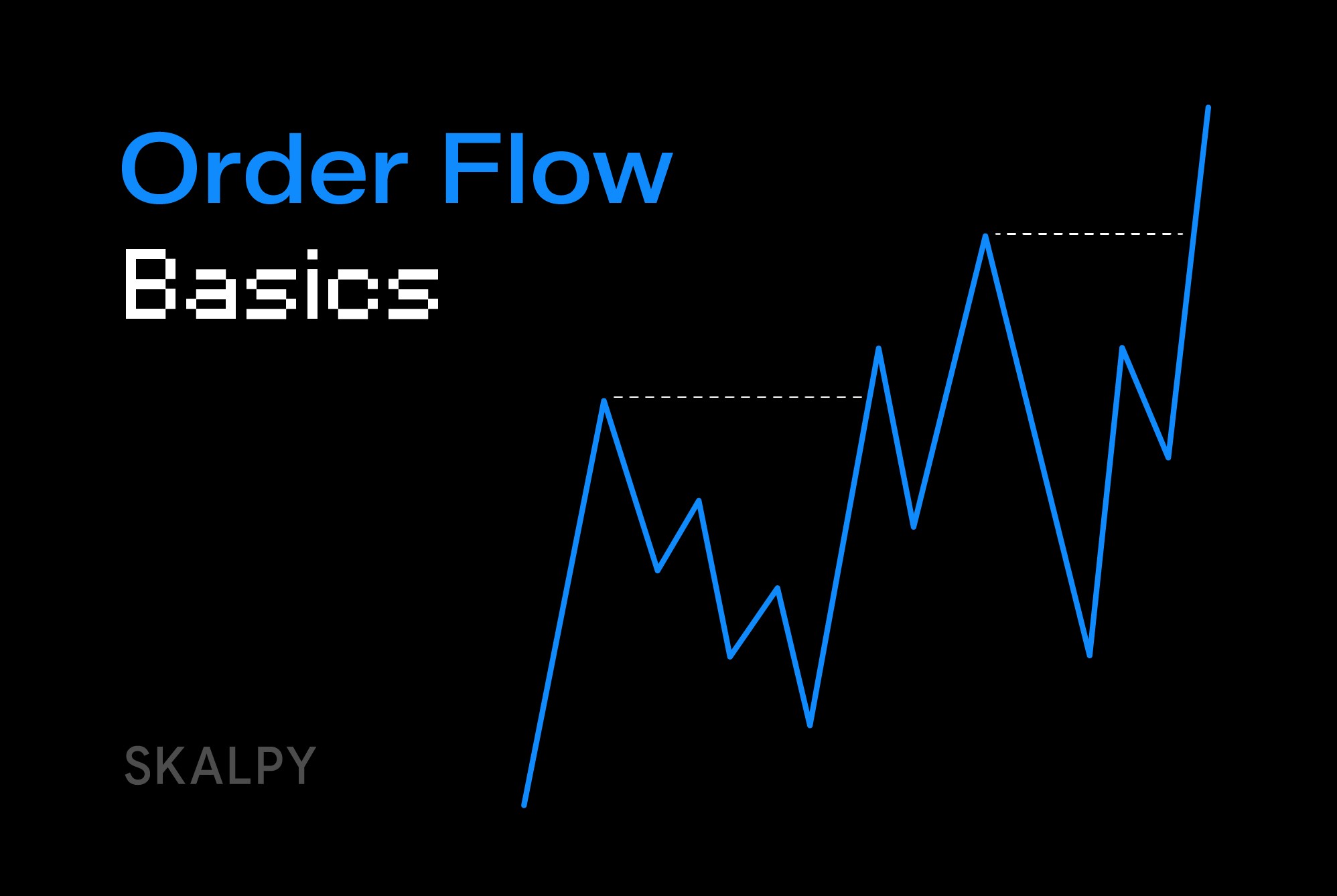

Liquidity Zones in Crypto Charts

Beyond general market liquidity, specific price levels exhibit concentrated liquidity that influences market behavior.

What Are Liquidity Zones: Price areas where many orders cluster, particularly stop losses and pending orders. Common zones include previous swing highs and lows, round psychological numbers (Bitcoin $30,000, Ethereum $2,000), and major support/resistance levels.

Liquidity Grabs: A liquidity grab occurs when price briefly spikes into a liquidity zone, triggers stops and pending orders, then quickly reverses. This appears as a "false breakout" or "stop hunt." The market absorbs liquidity at that level before moving in the true direction.

Understanding liquidity zones helps anticipate where price might spike, where reversals could occur, and where genuine breakouts might happen versus false ones.

Liquidity Across Crypto Assets

Major Coins (BTC, ETH): Exceptional liquidity on major exchanges. Tight spreads, deep order books, billions in daily volume. Ideal for all trading styles including scalping.

Large-Cap Altcoins (SOL, XRP, ADA): Good liquidity on major exchanges during active hours. Spreads typically 0.05-0.15%. Suitable for most trading strategies.

Mid-Cap Altcoins: Moderate liquidity. Spreads 0.2-0.5%. Requires caution for scalping. Better suited for swing trading.

Small-Cap Tokens: Poor liquidity. Wide spreads, thin order books, high slippage risk. Generally unsuitable for active trading.

Crypto Liquidity and Time of Day

Crypto markets operate 24/7 but liquidity varies significantly by time.

Peak Hours (8 AM - 6 PM EST): Highest liquidity when U.S. and European traders are active. Tightest spreads, deepest order books, best execution.

Asian Hours (8 PM - 4 AM EST): Moderate liquidity. Slightly wider spreads but still acceptable for major pairs.

Weekend Trading: Reduced liquidity, particularly Sunday evenings. Spreads widen, order books thin. Higher risk of slippage.

Scalpers should focus trading during peak liquidity hours when conditions are optimal.

Managing Liquidity Risk in Crypto

Stick to Liquid Pairs: For active trading, focus on BTC/USDT, ETH/USDT, and other high-volume pairs. Avoid low-cap tokens unless swing trading with wider stops.

Use Limit Orders: In lower liquidity environments, limit orders prevent overpaying. Market orders in thin markets can fill at terrible prices, especially during volatile periods.

Monitor Spread Changes: Widening spreads signal deteriorating liquidity. When spreads spike during volatility, tighten risk management or pause trading.

Size Appropriately: Even in liquid markets, extremely large orders can cause slippage. Scale into and out of positions when trading significant size.

Choose Exchanges Wisely: Trade on exchanges with the deepest liquidity for your chosen pairs. Binance, Coinbase, Kraken, and OKX typically offer superior liquidity.

The Bottom Line

Liquidity is the invisible foundation that determines whether your crypto trading strategy can work in practice. You might have excellent analysis and timing, but without adequate liquidity, execution problems will undermine everything.

For scalpers particularly, liquidity isn't just important, it's absolutely essential. Without tight spreads, deep order books, and fast execution, scalping simply cannot generate profits after transaction costs.

Prioritize trading the most liquid crypto pairs during the most active hours. Understand how liquidity varies across exchanges and times. Monitor liquidity conditions constantly and adjust your approach when they deteriorate. High liquidity markets offer the best environment for active crypto trading, minimizing costs and enabling skill-based edges to manifest consistently.