Scalping can be one of the most profitable trading strategies in crypto markets, but it's also one of the most dangerous without proper risk management. The high frequency of trades, leverage usage, and rapid decision-making create numerous opportunities for catastrophic losses if risk isn't controlled systematically.

The difference between scalpers who build consistent profits and those who blow up accounts isn't primarily about entry techniques or market reading. It's about disciplined risk management that protects capital through inevitable losing streaks and prevents single trades from causing serious damage.

Why Risk Management Is Critical for Scalping

High Trade Frequency Amplifies Risk

Scalpers execute dozens or hundreds of trades daily. With this volume, even small per-trade risk adds up quickly. A 1% risk per trade seems conservative, but losing 10 trades in a session equals a 10% drawdown. Without strict limits, losing streaks can devastate accounts before you recognize the problem.

Leverage Magnifies Both Gains and Losses

Most scalpers use leverage to make small price movements meaningful. While 10x leverage turns a 0.5% move into 5% profit, it also turns a 0.5% adverse move into a 5% loss. Leverage accelerates account growth but also accelerates account destruction. Risk management becomes exponentially more important when leveraged.

Emotional Decision-Making Under Pressure

Scalping involves rapid decision-making under pressure. When trades move against you quickly, emotion can override logic. Proper risk management removes discretion by establishing hard rules you follow regardless of how you feel in the moment.

Transaction Costs Compound

Every trade incurs fees and spreads. High-frequency trading multiplies these costs. If your risk management doesn't account for transaction costs, you might be profitable on price movement but still lose money after fees.

The 1% Rule: Foundation of Position Sizing

The most fundamental risk management principle: never risk more than 1% of your trading capital on a single trade. This rule ensures that even a devastating losing streak won't destroy your account.

With 1% risk per trade, you can lose 10 consecutive trades and only be down 10%. While painful, this is recoverable. Risk 5% per trade, and 10 losses equals a 50% drawdown, which requires a 100% gain just to break even.

Calculating Position Size

Position size calculation is simple: (Account Size × Risk %) ÷ Stop Loss Distance = Position Size

Example: $10,000 account, 1% risk ($100), stop loss 20 points away. Position size = $100 ÷ 20 = $5 per point. If trading Bitcoin at $30,000 with a $100 stop, you can trade 0.033 BTC.

This calculation must happen before every trade. Don't guess position sizes or use the same size for every trade regardless of stop distance. Proper position sizing adjusts based on your stop placement.

Scaling Down During Losing Streaks

When experiencing a losing streak, reduce risk per trade to 0.5% or even 0.25%. This slows capital erosion while allowing you to continue trading and potentially recover. Once you've demonstrated several winning trades, gradually scale back to 1%.

Many professional scalpers using platforms like Skaply adjust position sizes dynamically based on recent performance, automatically reducing size after losses and increasing after wins within predetermined boundaries.

Stop Loss Placement: Non-Negotiable Protection

Every trade requires a predetermined stop loss before entry. No exceptions. Stop losses aren't suggestions or guidelines. They're absolute boundaries beyond which you exit regardless of hope, fear, or conviction.

Technical Stop Placement

Place stops based on market structure, not arbitrary distances. For long positions, stops go below the recent swing low or support level. For short positions, stops go above the recent swing high or resistance.

The stop should be far enough to avoid getting stopped by normal market noise but close enough to keep losses acceptable. This balance requires understanding average price movement (ATR) for your timeframe.

Time-Based Stops

Scalping operates on short timeframes. If your trade thesis doesn't play out within your expected timeframe (minutes or hours), exit even without hitting your price stop. A trade that goes nowhere is tying up capital better deployed elsewhere.

Moving Stops to Breakeven

Once a scalp moves favorably, many traders move stops to breakeven (entry price) to eliminate risk. This guarantees you can't lose on the trade. However, moving stops too quickly can result in getting stopped at breakeven on trades that would have ultimately profited.

A common approach: move stop to breakeven once price moves 1.5-2x your initial risk distance in your favor. For a trade with a $50 risk, move stop to breakeven once you're up $75-100.

Never Moving Stops Further Away

If price approaches your stop, the temptation is giving the trade "more room" by moving the stop further away. This is disaster. Your original stop was placed for a reason. If price reaches it, your thesis was wrong. Accept the loss and move on.

Daily Loss Limits: Circuit Breakers

No matter how good your per-trade risk management, a bad day can compound losses. Daily loss limits create circuit breakers that stop trading before damage becomes severe.

Setting Your Daily Limit

A reasonable daily loss limit is 3-5% of your account. Once you hit this limit, stop trading for the day regardless of circumstances. Close your platform, walk away, and return fresh the next session.

This limit includes all losses: realized losses from closed trades plus any open losing positions. If you're down 3% on closed trades plus have an open position down 1%, you've hit a 4% daily loss limit.

Enforcing the Limit

The hardest part of daily limits is actually following them. After several losses, the impulse to "make it back" is overwhelming. This revenge trading almost always makes things worse.

Treat daily limits as absolute. When you hit yours, trading is over for the day. Non-negotiable. Your job is to follow the rule, not to question it in the moment.

Maximum Win Limits

Interestingly, setting maximum daily profit targets also helps. After achieving your daily goal (perhaps 3-5% gain), consider stopping. This prevents giving back profits through overtrading driven by overconfidence.

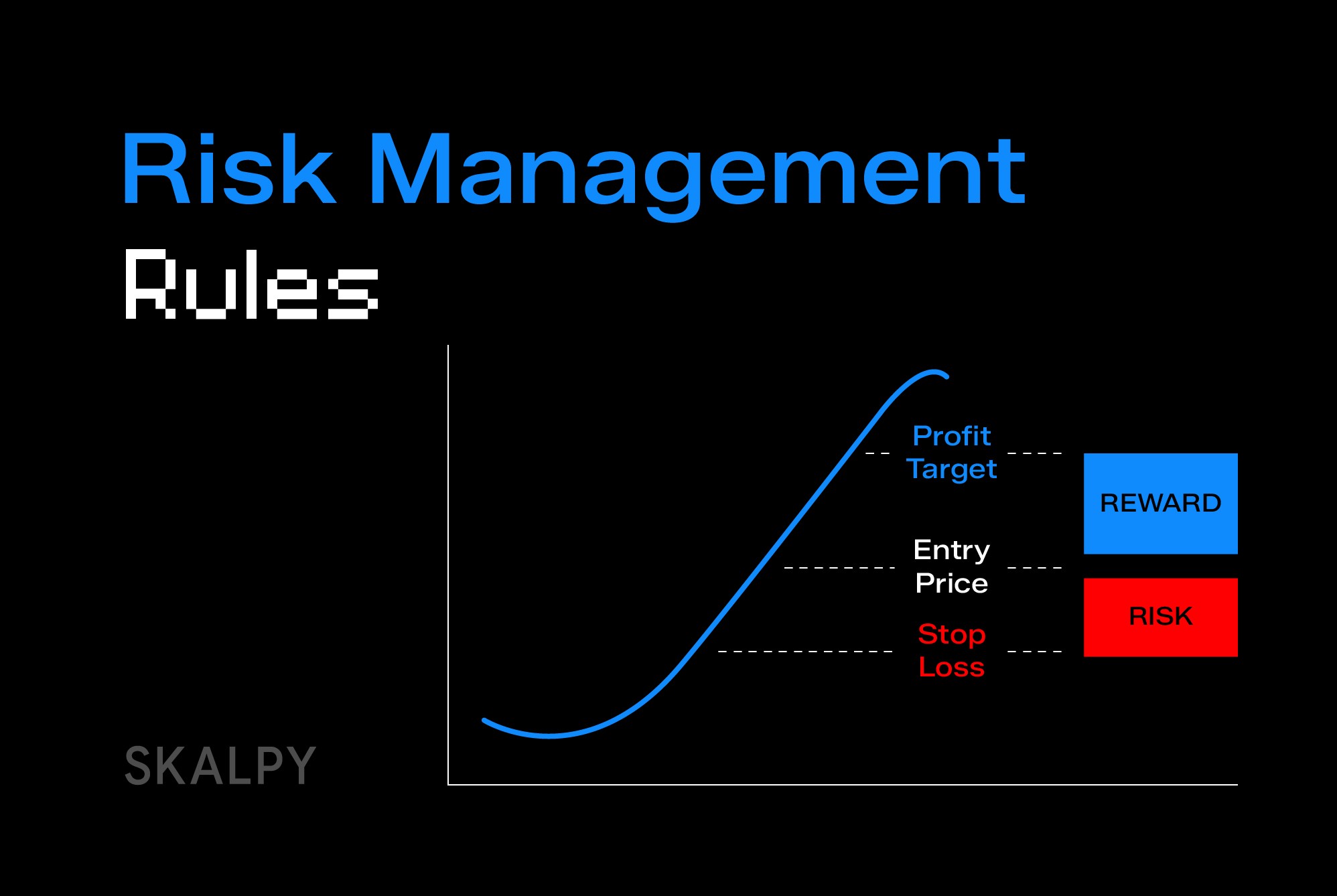

Risk-Reward Ratios: Trading Math That Works

Every trade should offer at least a 1:2 risk-reward ratio, meaning you target twice what you're risking. If risking $50, target at least $100 profit. This ensures you can be wrong more often than right and still profit.

With 1:2 risk-reward, you only need a 34% win rate to break even before costs. A 45-50% win rate generates solid profits. With 1:1 risk-reward, you need over 50% win rate just to break even, and costs push this even higher.

Setting Realistic Targets

Targets must be realistic based on market conditions. Don't force a 1:3 risk-reward when volatility and structure only support 1:1.5. Adjust expectations to what the market offers, and skip trades that don't meet minimum risk-reward requirements.

In ranging markets, 1:1.5 might be realistic. In trending markets, 1:3 or better becomes achievable. Read current conditions and set targets accordingly.

Leverage: Power Tool or Loaded Gun

Leverage amplifies both profits and losses. Used properly, it's powerful. Used carelessly, it's deadly.

Start Conservative

New scalpers should use minimal leverage (2-3x maximum) until demonstrating consistent profitability without leverage. Only after proving you can trade profitably should you gradually increase leverage.

Even experienced scalpers rarely use more than 10x leverage. Higher leverage looks attractive but creates margin call risk that ends trading careers.

Calculate Effective Risk

If you risk 1% of account value on a trade using 10x leverage, your effective risk is 10% if the position moves against you by the full stop distance. Always calculate effective risk accounting for leverage.

Reduce Leverage During Volatility

When markets become extremely volatile, reduce leverage or position sizes. Volatility spikes increase gap risk and slippage, making normal stop losses less reliable. Cutting leverage compensates for this increased uncertainty.

Managing Multiple Positions

Scalpers often hold multiple positions simultaneously. This requires additional risk considerations.

Correlated Positions

Don't take multiple positions on highly correlated assets. If you're long BTC and ETH, you essentially have a single larger position since they move together. If Bitcoin drops, both positions likely lose simultaneously, doubling your effective risk.

Maximum Exposure Limits

Set a maximum total exposure limit across all positions. Even if each individual position respects 1% risk, having 10 simultaneous positions creates 10% total exposure if they all go wrong together.

A reasonable limit is 3-5% total exposure across all positions. This ensures a worst-case scenario where everything moves against you simultaneously doesn't create catastrophic damage.

Scaling In and Out

Rather than entering full position size immediately, consider scaling in with smaller positions and adding to winners. Similarly, scale out of winning positions by taking partial profits at targets while letting remaining size run.

This approach reduces risk on initial entry while maximizing profit potential on trades that work.

The Psychology of Risk Management

Accepting Losses

The hardest part of risk management is accepting that losses are inevitable and normal. Every trade carries risk of loss. Perfect win rates don't exist. You will lose trades regularly regardless of skill.

Accepting this reality makes following risk rules easier. You're not trying to avoid losses, you're managing their size to ensure they're survivable and don't prevent long-term profitability.

Trusting the Process

Risk management feels restrictive when you're confident a trade will work. You want to risk more on "sure things." But sure things don't exist. The trade you're most confident about will sometimes be your worst loss.

Trust that following risk rules across hundreds of trades produces better results than breaking rules on individual trades based on confidence.

Detachment from Individual Trades

With proper risk management, no single trade matters significantly. This detachment improves decision-making since fear and hope have less influence when any one outcome is relatively insignificant.

Tools and Technology for Risk Management

Automated Position Calculators

Use position size calculators that automatically compute correct size based on account equity, risk percentage, and stop distance. This eliminates calculation errors.

Stop Loss Orders

Always use actual stop loss orders in the market, not mental stops. Mental stops fail when emotion takes over. Hard stops execute automatically regardless of how you feel.

Trading Platforms with Risk Controls

Quality platforms like Skaply offer built-in risk management tools including position size calculators, one-click stop placement, and automatic daily loss tracking. These features make following risk rules easier and reduce the chance of errors during fast-paced scalping.

Trading Journals

Maintain detailed records of every trade including risk amount, position size, stop distance, and outcome. Regular journal review reveals patterns in risk management adherence and areas for improvement.

Common Risk Management Mistakes

Over-Risking on "High Confidence" Setups

No setup is certain enough to justify excessive risk. Maintain consistent risk regardless of how good a trade looks.

Revenge Trading After Losses

After losses, the impulse to immediately recover leads to abandoning risk rules and taking trades that don't meet criteria. This compounds losses.

Ignoring Correlated Risk

Multiple positions on correlated assets creates concentrated risk that violates overall exposure limits even when individual positions seem reasonable.

Moving Stops to Avoid Losses

When price approaches your stop, moving it further away to "give the trade more room" destroys risk management. Accept losses when stops are hit.

The Bottom Line

Risk management isn't about preventing losses. It's about ensuring losses are controlled, survivable, and don't prevent long-term success. The best entry strategy means nothing if poor risk management eventually destroys your account.

Follow the 1% rule for position sizing. Use predetermined stops on every trade. Enforce daily loss limits. Maintain positive risk-reward ratios. Manage leverage carefully. These aren't suggestions but requirements for sustainable scalping profitability.

The traders who survive and thrive are those who treat risk management as sacred. They follow rules even when it feels restrictive, accept losses as business costs, and never let individual trades threaten their overall capital. Build these habits now, and you'll be among the minority who turn scalping into a consistent income source rather than a quick path to account destruction.